And now this……..

Some real impetus to adopt a CBDC is currently underway at the Bank of England (BOE). Several consultations have taken place with a range of market participants to gauge whether there is any possibility of rolling a CBDC out for general consumption. Well, given the research I have done in the crypto space, which at this rate is all the free time I have, I naturally have some thoughts. Sometimes you are aren’t able to put the genie back in the bottle. If this intrigues you, you are welcome to read on.

The Premise of a CBDC

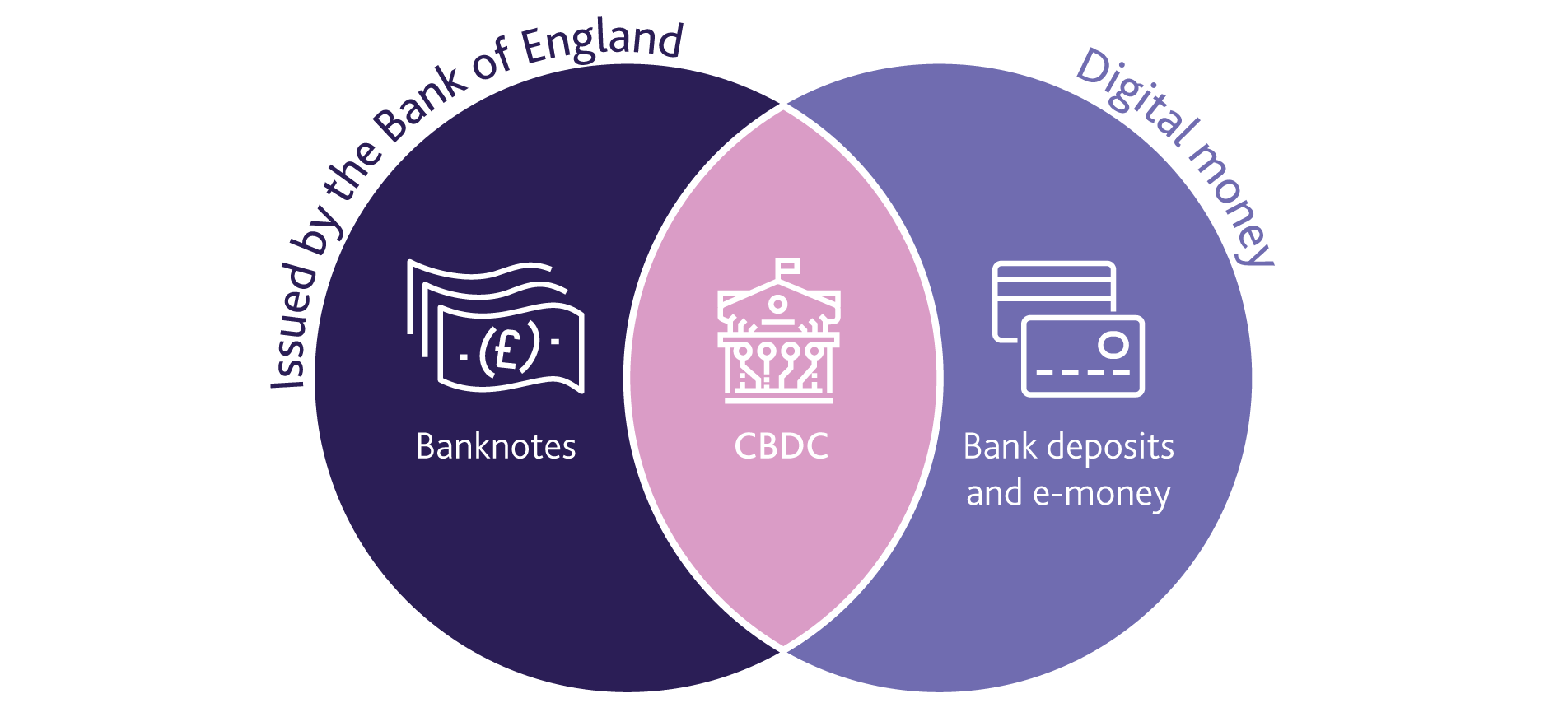

A Central Bank Digital Currency (CBDC) would allow households and businesses to directly make electronic payments using money issued by the Bank of England.

https://www.bankofengland.co.uk/research/digital-currencies

Theoretical Design

The Road Map, So Far

March 2020 – CBDC discussion paper outlines an illustrative model of CBDC designed to store value and enable UK payments by households and businesses.

April 2021 – The Bank of England and HM Treasury announce the joint creation of a Central Bank Digital Currency (CBDC) Taskforce.

May 2021 – A CBDC Engagement Forum to engage senior stakeholders and gather strategic input on all non-technology aspects of CBDC.

May 2021 – A CBDC Technology Forum to engage stakeholders and gather input on all technology aspects of CBDC from a diverse cross-section of expertise and perspectives.

June 2021 – The Bank of England moves ahead with CBDC with 7 job postings.

July 2021 – webinar held following the publication of the summary of responses to the 2020 Discussion Paper.

September 2021 – the Bank of England announced the membership of its CBDC Engagement and Technology Forums and they include some big names in technology and finance including Google, Mastercard, Consensys — and even Spotify

Some Considerations

Digital currencies and their position in the value spectrum: This is the introduction of a ledger with the BOE that would update each time someone does a digital transaction. Just like the current set of crypto currencies that are using a decentralised operational model. In this instance it would be a centralised ledger with the BOE that would update in real time and move value from one wallet holder to another. Value is located in the balances away from the balances is bank accounts.

Centralised in Nature: Should this be rolled out, where would the banks fit? This has the potential to circumnavigate the banks influence in the transfer of value. I.e. buyers and sellers of things interact directly with the central ledger via api’s, just like the current crypto’s. Now people have a balance of CBDC directly with the BOE and not their own bank. Remarkable.

Digital first: I obviously appreciate this one. The very reason we have online banking is to protect the downside should we lose all of our hard cash. This digital form of money would serve the same purpose.

Financial inclusion: This is a good conduct piece, use cases are still to be determined but this is a major move toward a truly inclusive financial environment. i.e. those without access to a bank account can digitally send value using this currency, without a bank.

Privacy: with the adoption of digital wallets and numbers of decentralised accounts, privacy would be almost guaranteed provided one can perform the right set of checks at onboarding and do this to a highly compliant standard. Clearly the BOE is going to rightly push for the tracing of wallet activity counter to the Zcash and Moneros of this world.

Instantaneousness: Digital currencies have the ability to pass value very cheaply and without the need for a middle man who would inevitably slow things down with bank 1.0 required checks and balances. This would be done via a process that the task force has called Real Time Gross Settlement (RTGS) something similar to the ‘mempool’ for BitCoin and Ether transactions.

High Level design

Central bank core ledger/database

A fast, highly secure and resilient platform that provides relatively simple payments functionality (the ‘core ledger’).

API access

Allows private sector Payment Interface providers to connect to the core ledger. Blocks unauthorised access — only regulated

entities can connect.

Payment Interface Providers

Authorised and regulated firms providing user-friendly interfaces between the user and the ledger. Many also provide additional payment services that are not built into the core ledger as overlay services.

Users

Register with Payment Interface Provider(s) to access CBDC.

This ‘layered architecture’ approach to tech infrastructure is becoming a common approach in value transfer, think payments, as it can help facilitate competition and innovation. Similar approaches have been taken by the New Payments Platform in Australia, Payments Canada’s Modernization programme, and it is also the model proposed in Pay. UK’s New Payments Architecture Programme in the UK. (Which I am yet to investigate.) No question there is merit to the silent redesign of the tech taking place at financial service providers.

Conclusion

I think this is the right way to go, the use case has already been proven in the usage of the internet to transfer value and the security that comes with the usage of clever cryptography. Much of these principles are explained in my other article called ‘My 4 BitCoin Revelations’ where I unpack the merits of crypto currency with Bitcoin as the focus. Much of the benefits of the BitCoin network and ecosystem can carry through to a Central Bank Digital Currency the implementation of which is actually easier that one thinks. This could happen quicker than the current adoption of cypto. See my other article on creating an ERC20 token called BoetCoin based on the Etheruem blockchain to see how quickly one can set something like up. The real challenge is the regulation that would need to be delivered at the same page of the tech, which at this stage isnt possible. So, as with most matters in financial services the tech teams are waiting on the regulators to catch up.